Innovate Market Access & Contract Analytics | Payer Rebates Strategy Segmentation

Contract Management Analytics

Contract Valuation in the Pharmaceutical Managed Care Environment is an increasing challenge and a major erosion of Company’s Profitability. It is estimated that in 2017, more than $125.0 Billion were “invested” in Rebates to effectively gain Profitable Market Access. It is increasingly difficult to assess where and when Rebates should be paid to Payer accounts and in exchange for what.

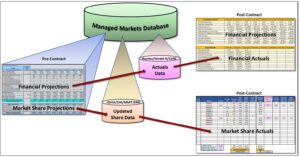

NavAxxess Health Solutions has developed an Innovative and State-of-the Art” “Contract Valuation Platform” that includes:

- Managed Markets Database with Payer – Linked Prescriptions and Formulary data. It typically contains iQvia or Symphony Health Solutions (SHS) for Prescription Data and MMIT or DRG/FingerTip for Formulary data.

- Customer Segmentation tool to help identify Key Payers – Health Plans and PBMs. Allows the categorization of Payers based on multiple parameters.

- Pre-Contract Valuation tool to aid in determining Rebates to optimize Profitable Market Access. Estimates “On” and “Off” contract performance to evaluate the incremental Profit Margins generated by Contracts with Payers. Contracting has become a routine issue not only for small molecule products, but increasingly for biological, large molecule products. This requires an innovative approach to contracting which requires the use of sophisticated and comprehensive Payer Segmentation tools, but more importantly tools to accurately predict the performance of Payer Contracts and estimate the Value of such Contracts to the Company. These tools should also be consistent to the Contracting Strategies developed by the Company in its approach to optimizing Profitable Market Access.

- Post-Contract Valuation Module to evaluate Payer-specific Share and Financial Performance. Compares Pre-Contract projected performance with Actual results and evaluates the on-going Profitability of a Contract with a Payer account. Post-Contract Valuation tools should carefully monitor volume and market share targets established by the Pre-Contract Analytics, and compare to actual performance reported by Market Audits.

Managed Markets Database

The Managed Markets Database is where all the data, assumptions, factors, indices, algorithms and Pre and Post Contract Valuation modules reside.

The Managed Markets Database Contains:

- Payer-specific Prescription data (from iQvia or SHS)

- Payer Formulary Structure and Restrictions (MMIT or DRG-FingerTip)

- Actual Claims Data submitted by Payers for Rebate Payment (e.g. Revitas, Model-N, iContract, Vistex, CARS, etc.)

- Pharmaceutical Company Financial Assumptions (COGS, Royalties, Discounts, etc.)

- Pricing Assumptions

- Marketing Assumptions

Using a Powerful Business Intelligence Reporting tool (Microsoft Power BI), access is provided to the Database for data visualization and to enable Payer Segmentation and Targeting based on multiple parameters.

Market Access Database

Most critical to success payer and Contract Valuations, is the development of a comprehensive Database that incorporates Health Plan Formulary data, including Benefit Designs, with prescription audits such as IQvia and SHS, and data from the company Contract Management Systems. Once this data is adequately bridged, innovative strategies can be implemented after a careful Payer Segmentation Analysis is concluded. Segmentation is essential for a successful implementation of Innovative Contracting and Contracting Strategies of the Company.

Pre-Contract Analytics

This is the central Module of the Contract Analytics Platform. Using several algorithms, it projects Pre and Post Contract Performance to determine Rebates to optimize Profitable Market Access. This Module incorporates:

- Payer Level of Control

- Performance Benchmarks for On and Off Contract Share or Prescription Volume

- Generated specific Response Curves based on Payer’s profile

- Estimates Incremental Profitability by comparing Gross Margins for On versus Off Contract Scenarios

- Incorporates Company Assumptions to generate most realistic Contracting Scenarios

- Estimates the NPV of a Contract and the Return on Rebates (Gross Margin generated by each dollar of Rebates paid)

- Stores this data for future comparison with Actual Results and Auditing Purposes

Post-Contract Analytics

The module periodically compares the Actual Performance of a Payer contract versus the projections generated by the Pre-Contract Valuation. It helps identifying performance issues in a Contract related to:

- Prices

- Volume variations

- Competitors’ Performance

- Impact of Pull-Through efforts

- Therapeutic Class Growth

- Impact of new Market entries

- Provides feedback to Payer Segmentation decisions

This model helps determine whether a specific Contract is achieving the expected results and, if not, identifies the potential causes so that remedial actions can be taken.